Money Has A Time Value

In these times of low inflation, it’s easy to forget or at least underestimate the impact of time on the value of money.

$1 today is worth $1. That is easy to understand. However, $1 last year was worth more than $1 today, and $1 next year will be worth less than $1 today.

One may believe that with inflation under 2% per annum, surely the impact of time on money is minor. But who knows of a business that has borrowed money at a 2% interest rate? Anyone? I certainly don’t. Most of the businesses I know are paying between 5 and 12%. And I am even not talking about the individuals or businesses that draw finance with a credit card and pay around 20%!

So money does have a time value and businesses need to take it into consideration when calculating future cash flows.

The general formula to calculate today’s value of a sum of money (or cash flow) that will be received in the future is:

Present value = Future value / (1 + Interest Rate) Time

By way of example, we can use this formula to calculate that $100,000 to be received three years from now, with a cost of money (interest rate) of 8%, has a value of $79,400 today.

The same goes with $100,000 to be received six years from now with a cost of borrowing of 10%: the value today is only $56,400.

An even easier way to calculate the value is by using pre-calculated discount factors.

Using pre-calculated discount factors, the formula becomes:

Present Value = Future Value x Discount Factor

All you need to know in order to use the above formula is:

- In how many years the money will be received

- The interest rate or the cost of borrowing the funds

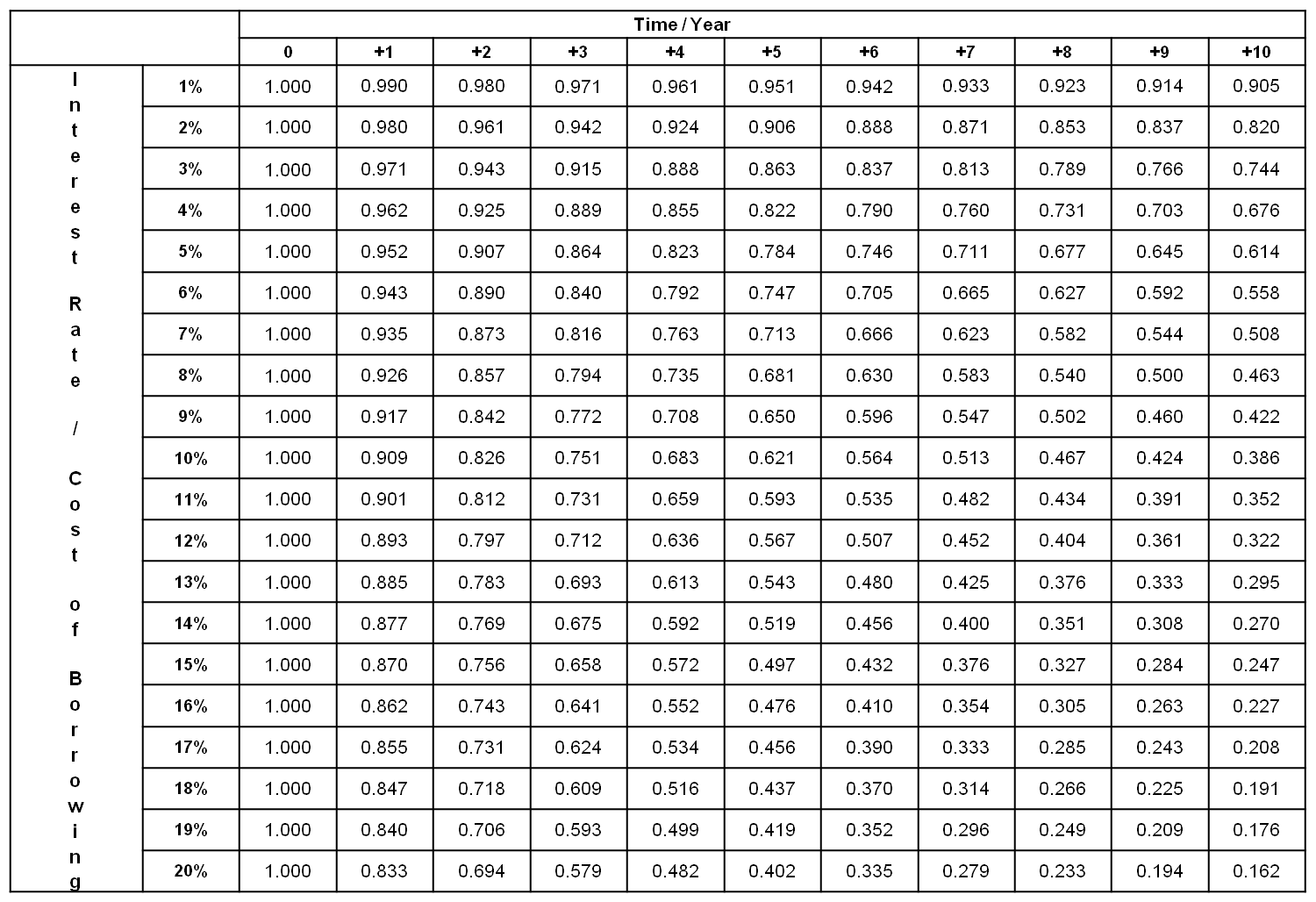

The discount factors are in the table below. The rows represent the interest rate charged by your bank or credit provider, the columns are the number of years from today in which the cash will be received.

Let’s take again our example of $100,000 to be received three years from now, with a cost of money (interest rate) of 8%. The intersection of the line “8%” with the column “Year +3” is 0.794.

So Present Value = $100,000 x 0.794 = $79,400

The same formula can be used for multiple cash flows to be received in different years. Just calculate the present value of each individual cash flow and add them all up.

So don’t forget to recognise the relationship between time and money as you work to build a sustainable business… and happy calculating!