It’s Payback Time! …or is it?

Everyone facing a business investment decision, such as launching a new product, purchasing equipment, installing a new production line, building a factory or acquiring a business needs to ask themselves the following questions:

How long before I get my money back?

Which of these investments is better?

The Payback Analysis provides us with a means to answer these questions by clarifying the length of time (weeks, months or years) required for an investment to reach breakeven, before it begins returning a profit. This length of time is called the Payback Period.

The calculation takes into account Incomes, Expenses (*) and Taxes. The shorter the payback period, the better. The longer the payback period, the longer funds are locked up and the riskier the project.

The Payback period can simply be defined as “when cumulative net cash flow reaches break even.”

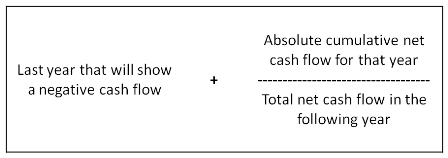

The formula for the Payback Period is:

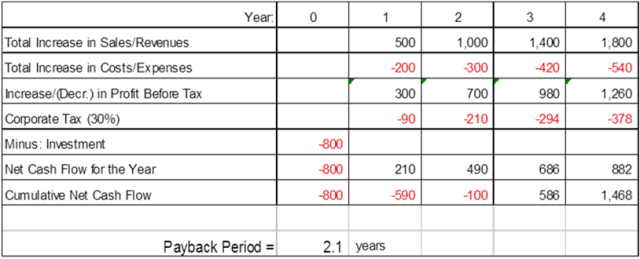

It may sound complicated, but it is actually quite simple when the figures are plugged into a table. Let’s take a look at an example:

In the above example the Payback Period = 2 + 100/686 = 2.1 years.

We also learn that the Cumulated Net Cash Flow at the end of Year 4 will be $1,468.

While this is helpful information, the Payback Period itself should not be seen as the only or ultimate investment decision tool. It has some limitations, the main one being that it does not consider the time value of money: i.e., with inflation, $1 today is worth more than $1 tomorrow (or the other way around, $1 tomorrow is worth less than $1 today).

A simple way to remove this limitation is by calculating the Discounted Payback Period. It is the same calculation, but takes into account the time value of one dollar.

Following on from our previous example:

Applying a discount factor for cost of funding = 10%, the Discounted Payback Period now stands at 2 + 204/515 = 2.4 years.

The Cumulated Discounted Net Cash Flow end of Year 4 changes to $914.

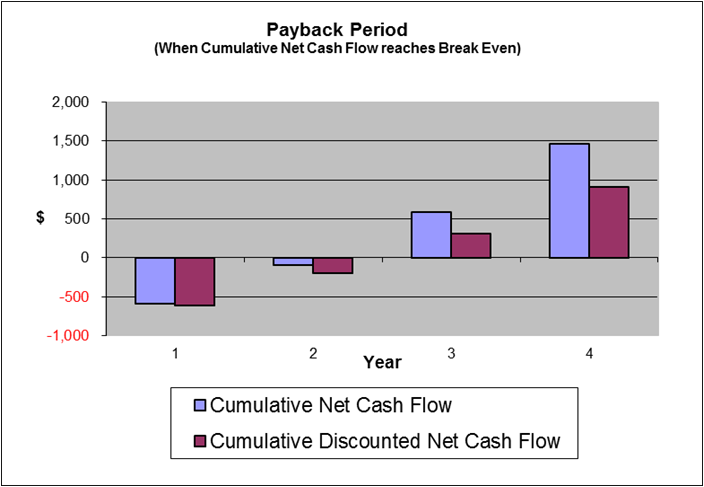

We begin to see a difference when taking into consideration a 10% funding cost:

Standard Payback Period = 2.1 years

Discounted Payback Period = 2.4 years

But look at the Cumulated Cash Flow:

Standard Cumulated Net Cash Flow = $1,468

Discounted Cumulated Net Cash Flow = $ 914

This is almost 40% less than what was expected: a significant difference!

For clarification, here are the same results presented in a graphic:

In conclusion, any mistake or oversight can be costly: not only might the break-even point be further away than you think, the cumulated cash benefit can be somewhat less that what you may have expected.

Do not leave your investment decision to chance: do your own calculations, or hire an expert to do them for you.

(*) Important Note: The Depreciation should be taken into account to calculate the Profit before Tax and the Corporate Taxes due, but, being a non-cash item, it should be added back into the Net Cash Flow for the year.

Eric de Diesbach

Founding Partner